You can get the amount of money as loan and depending on the various terms and conditions of various banks or institutions. It takes a few hours to get the money and pay it back as per your convenience.

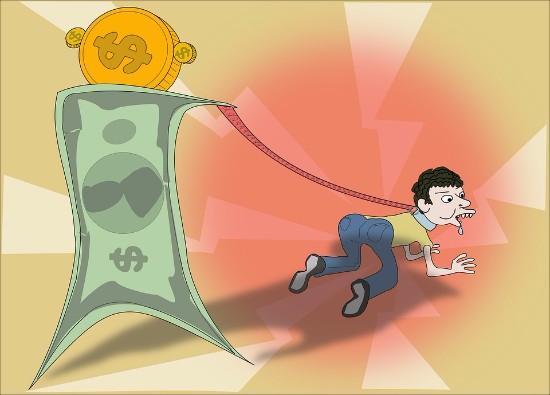

The time you can get for repayment can vary from 6 months to 10 years just depending on the total loan amount but longer the time for repayment, more the amount of interest you have to pay, sometimes when you wish to repay the total amount before the given period, you can be charged a penalty by the lender, in order to avoid any such case, you should go through the terms and conditions before borrowing the money. It is extremely important to study the terms in depth to avoid disputes or conflicts at a later stage.

Whenever you need a loan , the interest rate is decided which may vary lender to lender so its better to look around so that you can search a lender whose terms and conditions seems satisfying and the interest rate is minimal and when everything is done , you exactly know how much you have to pay back to the lender including the interest amount and accordingly the amount to be paid back every month is decided but there is one thing to notice that the Interest rates once finalized will not change if the interest rates for a new borrower are lower than that of yours , you have to stick to the same rate decided at the time of borrowing .

Whenever you go in for a secured or unsecured loan, the lender checks for if you have any bad credit history or unpaid loans which count as a negative point on your part and because of this many lenders can refuse for the loan. But there are some special companies who provide you with a loan amount even if you have a poor credit history but they can charge you for higher rate of interest in this case self-employed persons may come across some difficulties for approving their loans. Sometimes such persons go in to borrow the loan from small companies which offer a very high rate . Make sure to undergo all the calculations so that you are sure that you will be able to return the loan amount easily.

You can also go in for a loan insurance cover which helps you out at times when you are unable to repay the amount due to any valid reason like unemployment or illness ?

So purchase the things that you have longed and banks would lend you their helping hand to deliver personal loans, Home Loans or educations or for that matter trip to any foreign destination but read the terms carefully before you take a decision.